October 2, 2007 | EPI Briefing Paper #200 Work, work supports, and safety netsReducing the burden of low-incomes in Americaby Jared Bernstein Download print-friendly PDF version In a rich, advanced economy like the United States, poverty should be viewed as an aberration. To the extent that poverty exists—and this briefing paper defines poverty more broadly than the official method—it is largely a failure either of the market or of social policy. That is, the market may fail to produce enough jobs or income for those willing and able to work. Policies designed to support work may fail to adequately subsidize the earnings of those whose low wages, low productivity, or both, leave them with earnings too low to meet their needs. The safety net may also fail to catch those who are unable to work, due to their own personal limitations or disabilities. Those who are fully able yet unwilling to work may well be self-selected into poverty, but most of the low-income population does not fit into that category. Most families want to avail themselves of the best opportunities to raise their own living standards and their children’s life prospects. The U.S. economy and system of social welfare must ensure that they are able to do so. Thus, the aim of this briefing paper is to describe an agenda of social welfare policies that accomplishes the following goals:

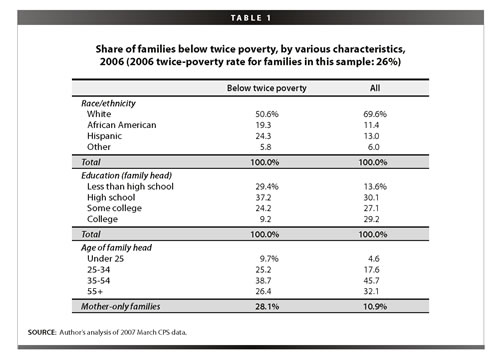

Along with setting goals, the nation needs to both track its progress, and motivate the political system to undertake these goals. To do so, this paper calls for reforming and refining the way the United States measures poverty and for setting concrete targets to reduce the share of the population whose income puts them under the updated poverty thresholds. Who is the target?As noted, the definition of who should be reached by this agenda goes beyond the officially poor, raising the question of how far should these policies reach up the income scale. Should they be universal, i.e., provide benefits to all regardless of income, or should they be income-tested? The official poverty measure is an inadequate gauge of whom this agenda should reach. The shortcomings of the official measure have been stressed in copious writings.1 While this paper will not rehash that literature here, there are a few points relevant to this policy analysis. First, since its inception in the early 1960s, the official poverty thresholds have been adjusted solely for price changes, and not for any changes in overall living standards or general economic growth. For example, in 1960, the poverty line for a family of four was about half the median income for a four-person family. Today, at about $20,000 for a family of four with two children, the threshold is around 30% of the four-person median. Clearly, the failure to update the thresholds has led to a situation in which the people officially designated as poor are falling further behind the mainstream. Second, since this paper’s approach to reducing poverty includes public investment in poor people, a measure is needed that reflects the impact of such spending. The official measure excludes some very important sources of support for the poor, including tax credits and non-cash benefits. Such a measure does not pick up the direct poverty reduction effects of these policies. Better measures exist, particularly those constructed based on the recommendations of the National Academy of Sciences (NAS),2 and they tend to reveal higher poverty rates relative to the official measure. But as poverty analyst Mark Greenberg stressed in recent Congressional testimony,3 policy directed at low-income persons need not be driven by one measure, especially a measure that is designed to measure the minimal amount of income needed to make ends meet. For example, the NAS measure is designed to meet a very narrow set of needs: food, clothing, shelter, utilities, and a little extra. As Greenberg notes: It leaves out many of the cultural enrichment activities that parents would view as essential to healthy child education and development. The approach was developed at a time when the Internet was first coming into our awareness, so it does not include costs for a family to own a computer or have Internet access. It does not explicitly provide room in the budget to save for education, or retirement, or home ownership, or future needs of children. It excludes, for example, any allowance to save for a child’s education, something higher income families do routinely, and something society presumably views as a valued investment. These points lead us to think more broadly about the target population. While a poverty, or low-income agenda, by definition excludes those who do not need the type of help are proposed here, it is important to balance the usual set of policy constraints (concern regarding negative incentives, budget constraints) against thinking too narrowly about who needs help in today’s economy. There is, of course, a continuum from families facing extreme deprivation, like homelessness, to the Bill Gates family (who clearly need no help from this system). The question is where to draw the line along that continuum, and the answer is that there exists no clear line impenetrable to attack from either side. The instinct, as embodied in the analysis in both this and the accompanying paper by Nancy K. Cauthen (2007), is to draw the line near two-times the poverty measure, though, in the spirit of progressive universalism, it is not always a fine line, i.e., some programs will phase out above this level. This twice-poverty line decision is not arbitrary. As discussed next, it relates closely to family budget measures that create an at least quasi-objective set of standards against which to benchmark economic well-being. In work on family budgets, economists (along with nutritionists, health care experts, etc.) have set out to tally the amount of income needed to meet a basic living standard, one where a generally accepted set of material needs is met. As Johnson et al. (2001) noted, “most budget standards have been calculated by building up a budget that would provide families with a modest, fair, or sufficient income.” EPI’s work on basic needs budgets for working families includes decent housing, an adequate diet, child care (when no parental caretaker is available), health care, transportation, and the money needed to pay taxes (Bernstein et al. 2000). Obviously, criteria like “modest,” “fair,” and even “sufficient,” are normative judgments, although, as noted above, family budgets are often based on expert opinion, such as when nutritionists recommend an adequate diet. But there is simply no single “right” way to measure such concepts, including poverty. When we engage in this exercise, we balance a variety of needs, sensibilities, and political, if not existential, considerations. Our concerns regarding material deprivation lead us to heavily weight absolute measures, but equity concerns raise the importance of relative measures, too. There is a distribution of well-being, and it would be unreflective of realistic outcomes in a market economy to designate, say, everyone below the 80th, or even the 50th percentile of the income scale as “poor.” Yet, it would be unjust in an affluent, highly productive economy to label only those facing the most severe material deprivation as poor. Family budgets attempt to balance many of these concerns by recognizing that families who are unable to meet basic needs—needs that derive in part from societal standards (and thus have a relative component)—face a material It is notable that the budgets needed to meet basic needs come up with income levels well above poverty thresholds, usually in the range of two-times their value. For example, Johnson et al. (2001) report a basic-needs family budget for a married couple with two children of $36,550 in 1998; Allegretto (2005) reports a family budget for the same family type of just under $40,000 for 2004.4 In both cases, these budget levels are about twice the official poverty threshold for that family type. In fact, Allegretto’s work shows that while about 9% of the family types she examines (her work only looks at working families with children) are officially poor, about 30% are below the family budget thresholds, just about the same share that has been found in recent years to be below twice the poverty threshold. In this regard, the core target is roughly those in the bottom third of the income scale, or up to about twice poverty. Table 1 shows the characteristics of those families. Over-represented groups include: minorities, younger families, families headed by someone with less than a college education, and mother-only families.

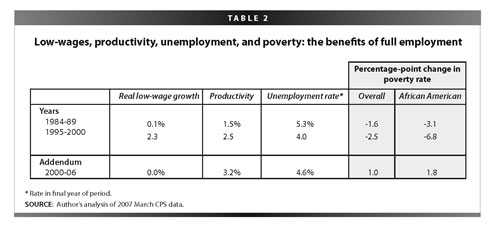

Another point regarding targeting is in regards to age and the lifecycle. The agenda described herein is generally targeted at working-age families and their children. The poverty of the elderly is of course a serious concern, and they too should be protected by an adequate safety net, as elaborated below. But the economic well-being of the non-working elderly is considered here to be a function of their savings, pensions, and Social Security, all issues that are discussed elsewhere in the Agenda for Shared Prosperity.5 Progressive universalismThe fact that this agenda targets those in the bottom third of the income scale should not be taken to mean that it offers no support to higher income workers. History teaches us that means-tested programs tend to ensure a limited reach, both in economic and political terms: programs exclusively for the poor tend to be poor, unpopular, and under-funded programs. At the other end of the policy continuum is a universal approach, in which the same benefits are available to everyone irrespective of their income. However, this approach can have significant budgetary costs while yielding smaller benefits to the targeted group. Thus, a hybrid concept borrowed from the (thus far quite successful) British anti-poverty agenda is suggested: progressive universalism. Under this approach to eligibility, everybody gets something, but the neediest get the most. Some aspects, like universal health care coverage, will reach everyone, while others, like the EITC and food stamps, will phase out at higher income levels. The important point is that the plan as a whole stresses some extent of universality. Another reason for this approach is the increase in income volatility. Higher volatility means more families will temporarily experience hardship, thus poverty needs to be increasingly viewed as a temporary condition, with safety nets ready to quickly “catch and release” those temporarily experiencing a bad year or two. The federal Earned Income Tax Credit (EITC) reduces the income tax liabilities of low- to moderate-income working families—that is, families with annual incomes of up to about $38,000—and serves as a wage supplement. Since the EITC is refundable, any amount of the credit that exceeds a family’s tax liability is received as a cash payment. By definition, only families with earnings are eligible for the benefit. The programThis program consists of a straight-forward, three-part agenda: tight low-wage labor markets, robust work supports, and revitalized labor market institutions. The first prods the market toward its potential, squeezing the optimal returns out of the primary distribution of wages and incomes; the second picks up the slack, filling out family budgets by making up the difference between what people earn and what they need; and the third provide low-wage workers with the clout they lack to ensure that they receive fair returns for their labors. In addition to these fundamental components, we advocate new, comprehensive poverty measures and changes to the safety net to correct imbalances that have arisen in recent years. Getting the most out of the low-wage labor market The importance of full employment has been stressed in another set of paper from the Agenda for Shared Prosperity project (Palley 2007; Madrick 2007), and I have written extensively about those benefits in terms of wages and incomes (Bernstein and Baker 2003; Bernstein 2007). Since full employment tends to disproportionately raise the bargaining power and income share of the least well off, it has powerful anti-poverty effects as well.6 Most recently, those impacts were on display in the latter half of the 1990s. Table 2 compares two five-year periods, 1984-89 and 1995-2000: the last five years of two expansions (the current cycle is an addendum for comparative purposes, but these years are not comparable regarding the business cycle). The data show changes in low-wage growth (annualized growth of the 20th percentile wage), average productivity, the level of unemployment at the end of the period, and changes in poverty rates, overall and for African Americans.

The numbers tell an important story, namely: strong productivity growth creates the potential for faster wage growth for low-wage workers (and throughout the pay scale). But in the absence of job markets tight enough to push employers to bid wages up to get and keep the workers they need, this potential is unlikely to be realized. These connections between productivity growth, unemployment, faster low-wage growth, and poverty reduction, are especially relevant in a policy climate where work in the paid labor market is the central pathway out of poverty, a pathway we very much support. The 1980s were characterized by relatively high unemployment—the average over the cycle was 7.1% (1979-89), compared to 5.6% in the 1990s cycle (1989-2000)—slow productivity growth, flat low-wage growth, and fairly sticky poverty rates (down less than 2 percentage points over the heart of the 1980s expansion). Over the comparable period in the 1990s, productivity growth was strong, accelerating more than 1% over the 1984-89 rate, unemployment was a lot lower, and most notably, low-wage growth accelerated significantly. In fact, these years represent the only time over the past few decades when low wages grew in step with productivity. The 2000s addendum is informative too, though as noted, the dates are not cyclically comparable. Productivity grew even faster, 2000-06, up 3.2%, but unemployment rose in the recession of 2001, and even while it remained low by historical standards, it remained above the full-employment level of 2000.7 Lacking the pressure of tight labor markets, real low-wage growth disappeared. Along with tight job markets, key labor market institutions, such as unions and minimum wages, also play a critical role in squeezing the most poverty-reducing effects out of the job market. Union benefits are particularly pronounced for low-wage workers, both in terms of wages and especially benefits, including health care, pensions, time off, and working conditions.8 Revitalizing unions is the subject of other papers as part of EPI’s Agenda for Shared Prosperity.9 Non-labor market factors at work The poverty rates in Table 2 suffer from the inadequacies noted earlier. This is important to the analysis here because there were important policy changes, such as the 1992 EITC expansion, that are not accounted for in the official measure. A more complete measure developed by poverty analyst Wendell Primus incorporates this and some other similar changes (his measure is closer to the NAS approach than the official). Between 1992 and 2000, when official poverty fell 3.5 percentage points, this more comprehensive measure fell 6.2 points.10 Ellwood (2000) carries the analysis a bit further, simulating a full set of changes in wage and income policies relevant to low-income, working families. Comparing the relevant policy set of the mid-1980s to the of the mid-1990s, he finds that the increase in the minimum wage, the expanded EITC, and increased child care support, raised the after-tax income of a single parent moving from no work to a full-time job at the minimum wage by over $5,000 (1996 dollars; that amounts to $6,500 in 2007 dollars).11 As noted, this period also saw an increase in the minimum wage, both at the federal level and across many states. Though opponents of the mandated wage boost argued that it would lead employers to lay off affected workers, research over the period found few examples of such job losses. To the contrary, the low-wage labor market was particularly robust in these years. Of course, major reform of the welfare system occurred in the 1990s as well, and a great deal of analysis has been devoted to figuring out its impact on the economic conditions of affected families. Summarizing, it has proved quite daunting to separate out the policy impacts specific to welfare reform from those of all the other moving parts, both in the market economy (the move toward full employment) and the complementary changes like the EITC expansion or minimum wage increase. Most convincing, however, are the claims that welfare reform raised the labor supply of affected persons. Empirical analyses reveal a greater labor supply response by low-income single mothers when compared to married mothers, one that could reasonably be assigned to welfare reform. Yet, here too, the fact that the push of the reform legislation was met by the pull of both strong labor demand and supportive income policies played a critically important role. In fact, recent research by Congressional Budget Office (CBO) on the incomes of low-income single mothers (including near-cash benefits and the EITC) reveals that after rising quite steeply in the 1990s—4.3% per year in real terms—incomes fell by 2.6% annually, 2000-05.12 The decline in employment opportunities, as full employment was replaced by the jobless recovery, showed up not only as reduced annual earnings, but also as reduced EITC benefits. This raises an important concern in anti-poverty policy, one taken up below: has the safety net become too pro-cyclical? Using the results regarding low-income single mothers, it seems possible that the current safety net is effective in periods of full employment and ineffective when the economy slows or declines. Given that a critical purpose of safety nets is to catch vulnerable families when downturns occur, this possibility warrants serious concern. Work supports: closing the gap between earnings and needs Building on, extending, and strengthening the existing system of work supports is at the heart of this program. The goal is to federalize a comprehensive set of work supports, ensuring eligibility and adequate funding to all whose paychecks are inadequate to their needs. Given its primacy in this low-income policy architecture, the Agenda for Shared Prosperity devotes a separate paper by Nancy K. Cauthen (2007) to these issues. Here, for completeness, this paper simply defines the terms of work supports. Broadly speaking, work supports are any publicly-provided income that either boosts the earnings of low-income workers, or helps offset the cost of a family budget component, including health care, child care, housing, and transportation. Cauthen’s research into work supports finds abundant evidence that such benefits positively affect employment and earnings. For example, a series of expansions in the federal Earned Income Tax Credit (EITC) has been credited with contributing to an increase in employment and decrease in poverty among single-mother families from the late 1980s to the mid-1990s. Both the federal and state governments substantially increased spending on work supports in the 1990s—especially for the EITC, health insurance coverage, and child care subsidies. Nonetheless, Cauthen contends that the current U.S. work support system falls far short of adequately meeting the needs of low-wage workers. Among her key findings:

Cauthen argues that many limitations of existing work support programs stem from their origins in the welfare system. In the past, Medicaid and child care subsidies were available primarily to cash assistance recipients, and housing subsidies and food stamps were dispensed without regard to employment status. Extensive reform over the past decade—starting with welfare reform in 1996 and the creation of the State Children’s Health Insurance Program in 1997, along with implementation of work requirements in food stamps and housing programs—went a long way toward: (1) uncoupling means-tested benefits from cash assistance, and (2) making the receipt of benefits contingent on employment or work-related activities (at least for the able-bodied). Although these accomplishments should not be underestimated, substantial challenges remain:

In sum, Cauthen argues that the United States needs “a comprehensive, integrated work support system that is explicitly designed to address the challenges faced by ever-growing numbers of America’s workers and their families.” New poverty measures and targets Numerous anti-poverty advocates have raised the idea of following the lead set by the Labor Party in the United Kingdom by setting a poverty target. In the U.K. case, in 1999 the Blair administration set the very ambitious goal of ending child poverty by 2020, with interim goals of 25% and 50% reductions. The Center for American Progress poverty task force embraced the targeting strategy, recommending, “the United States should establish a national goal of cutting poverty in half over the next ten years and setting the nation on a course to end poverty in a generation.” We agree that this target makes sense. Obviously, there are political risks involved, as goals may not be met, even in the face of good faith efforts. But analysis of the U.K. experience so far suggests that a poverty target can be a highly effective way of focusing policy makers’ energies on an important cause that, given the relatively weak clout of the poor and their advocates, is too often not on the list of top policy priorities. The CAP task force makes some bold (and sensible) recommendations of administrative changes to accompany the targeting agenda. They suggest, for example, that the president set the goal by executive order, then assign various cabinet positions to track progress and publish an annual report. In the U.K., a similar role was fulfilled by their Social Exclusion Unit, a cabinet-level agency created to achieve the goal by tackling the combination of problems that interact to keep families poor, such as a lack of marketable skills, chronic unemployment, and poor housing in high-crime areas. Of course, the United States cannot set a viable goal if it does not have a viable poverty measure. In terms of this part of the policy agenda, a measure is needed that can reliably track any progress. As noted above, the official measure is inadequate to this task for lots of reasons, most importantly because it fails to count the value of post-tax and non-cash benefits. Thus, it will fail to register progress made at those margins. The NAS measure, as implemented by the Census Bureau, provides a good solution to this problem, though other, more relative measures (such as a share of median income) should also be tracked (the favored U.K. measure is a relative measure). Some of the limitations of the NAS measure were noted above, but 1.) it is the best and most widely accepted poverty measure, 2.) it accurately tracks progress against poverty (i.e., it accounts for taxes and most non-cash benefits (though not publicly-provided health care)), and 3.) the technology to produce the measure exists within the government. The safety netAn adequate safety net—a set of policies to support the living standards of workers and their families when markets fail—is an established, important component of all advanced economies, including the U.S. economy. But the effectiveness of the U.S. safety net is too often subjected to the whims of politics and ideological views, economic incentives, and human behavior. For example, conservatives often argue against safety net programs, from welfare benefits to unemployment insurance (UI), believing them to be fraught with negative incentives regarding work. Liberals argue that these effects, while present, are minimal and do not lead persons to work (or seek work) much less aggressively than would otherwise be the case. The welfare reform debate certainly came down solidly on the conservative side of this argument, and thus work requirements were central to the legislation. Recent conservative initiatives regarding UI have also reflected these concerns, and have thus been much less focused on extended access and more focused on creating incentives to diminish the length of UI spells.13 In the context of this work/work supports framework, this agenda views the role of the safety net as 1.) maintaining income/consumption when work in the paid labor market is un- or under-available, and 2.) providing adequate income/consumption for those unable to work. As noted above, there is evidence, especially in the case of low-income single mothers, that welfare reform has led to a safety net that is too pro-cyclical instead of counter-cyclical, i.e., it helps boost incomes when the job market is strong, but fails to replace lost incomes when it is weak. There are two solutions to this problem: direct job creation through public service employment (PSE) to offset weak private sector labor demand, and increased income supports, e.g., through welfare benefits or UI. The important point, in the context of this framework, is that work supports are less effective when work is not available. Of course, work does not wholly disappear in downturns. Some workers will find themselves not necessarily out of work, but working fewer hours. In such cases, it is important that work supports conform to this reality. For example, given the structure of the EITC, the loss of hours could either move a worker onto the EITC schedule, or lower their benefits. The latter is to be avoided, or at least offset by increased benefits elsewhere. In terms of pure income transfers, anecdotal and some statistical evidence suggest welfare rolls have become much less responsive to rising unemployment. For example, they appeared to rise considerably less in the 2001 downturn and jobless recovery than the prior correlation between these two variables would have suggested. Also, welfare receipt to lower income single mothers fell quickly in real terms over this period (see CBO reference above, for example, showing a 6.5% annual real decline in welfare benefits, 2000-05, for this population). Thus, the United States needs to restore counter-cyclicality—the sine qua non of safety nets—to the primary welfare system, Temporary Assistance for Needy Families. Policy makers must review why the rolls and cash transfers have been unresponsive, asking, for example, is this a policy-induced problem, caused by TANF changes such as time limits to benefit receipt, or a behavioral shift at the “street level,” wherein welfare administrators have become to restrictive with eligibility. Similarly, UI needs updating to accommodate the realities of today’s workplace and the less steady work histories of many in the low-wage sector. We support the UI agenda put forth by the National Employment Law Project, as embodied in the UI Modernization Act.14 The act calls for increased federal contributions to state UI systems; alternative base periods that recognize a workers recent work history (and thus raises eligibility for low-wage workers); and improved UI access for part-timers, women workers, women with families, and persons facing long-term joblessness. Finally, there is a role for direct public-sector job employment, or PSEs, to create employment opportunities for the least advantaged in society. It is well established that even at full employment, some groups of potential workers will remain disconnected to the labor market. Young African American men with less than high school educations are one example stressed in the work of Edelman et al. (2006).15 Savner and Bernstein (2004) raise the idea of a localized approach to PSEs to help such workers, and in this context, this a valid role for the safety net to address a profound, though highly concentrated market failure affecting particularly vulnerable populations. Savner and Bernstein (2004) argued that in very slack labor markets, we should draw on the successful experience of transitional jobs programs that create employment for those marginally attached to the job market. Quoting from that work: Such jobs could meet important community needs and let people use their newly minted skills. What’s more, the message is clear and consistent with values we all agree with: Everyone who wants to work should have the chance to do so. The beauty of this approach is that it takes on both deficits, skills and jobs. Reflecting on the critique from the left, this approach guarantees that recipients of job-training programs are ‘all dressed up with somewhere to go.’ In any new system, we need to avoid the errors of the past, chief among them the displacement of incumbent workers. One idea is that the jobs-creation component, likely the big-ticket spending part of the package, could switch on in local labor markets when the unemployment rate got too high—and off when no longer needed. As with any other potentially expensive new social policy, it would make sense to test this idea with a few local demonstration projects. ConclusionThis anti-poverty framework is quite simple. First, there is a broad definition of poverty, going well beyond the current, official measure. This program reaches the broad swath, perhaps a third of families, unable to make ends meet in a way commensurate with reasonable expectations in an advanced, wealthy economy like the United States. Second, it ensures that those who seek gainful work have ample opportunities to find appropriately remunerative work. This leads to both full employment policy, and an emphasis on work supports. Finally, it provides a more robust safety net to reach those beset by market failures. Thanks to Mark Levinson, Nancy K. Cauthen, and John Irons for helpful comments, and to James Lin for research assistance. Endnotes

ReferencesAllegretto, Sylvia. 2005. Basic Family Budgets: Working Families’ Incomes Often Fail to Meet Living Expenses Around the U. S. EPI Briefing Paper #165. Washington, D.C.: EPI. http://www.epi.org/content.cfm/bp165 Bartik, Timothy J. 2001. Jobs for the Poor: Can Labor Demand Policies Help? New York and Kalamazoo: Russell Sage Foundation and W.E. Upjohn Institute for Employment Research. Bernstein, Jared, Chauna Brocht, and Maggie Spade-Aguilar. 2000. How Much is Enough? Basic Family Budgets for Working Families. Washington, D.C.: EPI. Bernstein, Jared, and Dean Baker. 2003. The Benefits of Full Employment: When Markets Work for People. Washington, D.C.: EPI. Edelman, Peter, Harry Holzer, and Paul Offner. 2006. Reconnecting Disadvantaged Young Men. Washington, D.C.: Urban Institute Press. Ellwood, David T. 2000. Anti-poverty policy for families in the next century: from welfare to work—and worries. The Journal of Economic Perspectives, Vol. 14, No. 1., pp. 187-98. Winter. Johnson, David S., John M. Rogers, and Lucilla Tan. 2001. A century of family budgets in the United States. Monthly Labor Review. Vol. 124, No. 5. Washington, D.C.: Bureau of Labor Statistics. Wider Opportunities for Women Self-Sufficiency Standards can be found at: www.wowonline.org. Madrick, Jeff. 2007. Breaking the Stranglehold on Growth: Why Policies Promoting Demand Offer a Better Way for the U.S. Economy. EPI Briefing Paper #192. Washington, D.C.: EPI. http://www.sharedprosperity.org/bp192/bp192.pdf Mishel, Lawrence, Jared Bernstein, and Sylvia Allegretto. 2006. The State of Working America 2006/2007. Palley, Thomas. 2007. Reviving Full Employment Policy: Challenging the Wall Street Paradigm. EPI Briefing Paper #191. Savner, Steve, and Jared Bernstein. 2004. Can better skills meet better jobs? The American Prospect. September 1. Download print-friendly PDF version

|

|

|||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||